Housing Market California

Both Realtors, investors, home buyers and renters across California continue to wait in limbo for the 2024 California housing market to unfold. Is this spring the “inflection point” the media have touted for markets?

California Realtor Sentiment in December. Screenshot courtesy of CAR.org.

California Realtor Sentiment in December. Screenshot courtesy of CAR.org.

Is this the year, frustrated buyers will finally have the opportunity to buy, or will rising home prices leave them all behind? While mortgage rates and payments declined in December, home and condo prices climbed slightly. And as the charts below reveal, active listings are weakening. Despite growing optimism in consumers, the properties simply aren’t there nor affordable.

Improving Sentiment is Noteworthy

Surveys show consumer sentiment is rising and Realtor’s outlook is positive as well. Most of it might be ignoring the lagging effects of the rapid FED rate hikes, and focusing solely on cheaper mortgages coming. But sellers will still face steep challenges in selling their homes.

And stats show that homeowners aren’t listing their homes. And new reports have it that baby boomers aren’t willing to let go of their homes. There doesn’t seem to be a solution for the housing crisis, and as the US and California economy return perhaps later this year, it’s easy to see home prices in California picking up pace.

California Association of Realtors’ latest report reveals single-family home sales across the state stayed flat for December 2023, while being down 7.1% from Dec 2022.

The statewide median price for houses fell .3% from November, yet is still up 4.3% from 12 months ago.

Home prices follow normal seasonal pattern. Screenshot courtesy of CAR.org.

Home Prices Still in Upward Trend

Are new record prices predicted for 2024? Despite the seasonal trend, as you can see in the CAR chart below, home prices fell last year with a decided reversal in 2023.

Home Price Growth Chart California. Screenshot courtesy of CAR.

Home Sales in December

Sales fell again in December. However, year over year we saw a shocking decline of 24.8% in sales. 2023 was a year many would like to forget. And now the question is, will 2024 bring improvement? As you’ll see below in the charts, the trend is toward fewer listings and higher prices. That’s not necessarily good news for buyers or rental property investors, as sellers feel they can get a better price later.

Homes sales as bad as the Great Recession. Screenshot courtesy of CAR.org.

Demand Never Seems to Fade in California

While the state has suffered a major loss of businesses and residents, there is a continuous supply of new residents arriving and businesses being formed. The attraction of the Golden State never seems to falter.

The FED continues to struggle with its battle with inflation while sending signals both ways regarding expected rate cuts this year. There’s lots to consider in weighing the California real estate market outlook besides mortgage rates. Consumer spending, which has supported the economy may have to continue doing so, until more housing can be built and small business gets full traction again.

Sales of existing resale homes rose very slightly at a seasonal rate of 224,000.

The good news is that mortgage rates have stayed below last October’s levels and will likely fall further as the year progresses. Without knowing how the FED will react to a slowing economy, it’s difficult for buyers and sellers to know what to do.

Mortgage rates and payments decline. Screenshot courtesy of CAR.org

Mortgage rates and payments decline. Screenshot courtesy of CAR.org

Current 2024 C.A.R. President Melanie Barker said, “The housing market had a tough year in 2023 as a shortage of homes for sale and high costs of borrowing continues its negative impact on housing inventory and demand. With mortgage rates expected to come down in the next 12 months, home sales will bounce back as buyers and sellers return to a more favorable housing market. Home prices should see a moderate increase in 2024 as well.”

Sales in all major California housing regions dipped in December with the Central Valley and San Francisco regions seeing the largest declines (14.8% year over year) and (-11.8% year over year) respectively. 37 of 52 counties saw a reduction in sales year over year.

Home prices on the other hand rose in all regions with the Central Coast and the San Francisco Bay Area rising 12.6% in median price.

Unsold inventory fell 16.7% month over month across the state and supply was reduced from 3 to 2.5 days.

Active Listings

Active Listings declined year over and from November.

Active Resale Home Listings Drop. Screenshot courtesy of CAR.org.

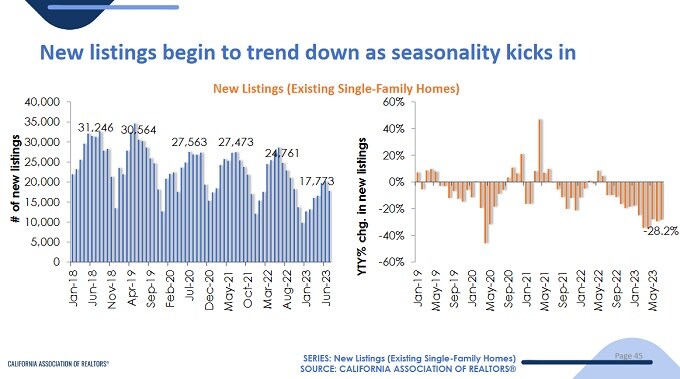

New Listings

New Home Listings Still Negative. Screenshot courtesy of CAR.org.

Housing Supply Chart

Housing supply continued its relentless slide as more than half 52 counties reported drops.

California Housing Supply Falls. Screenshot courtesy of CAR.org.

Home Prices County By County

The biggest home prices changes month to month occurred in Santa Barbara with a 32.2% rise to $1,190,000, San Bernardino up 6.5% to a new median price of $506,000.

The largest drop in prices came in San Francisco, down 5.5% to $1,450,000, San Diego down 4.3% to $911,500, Contra Costa down 7% to $800,000 and Alameda down 4.5% to $1,175,000. Napa saw a price growth in December of 12% or $100,000 to $925,000.

Napa County after a 15.4% in price during October, saw a big downshift of 19.7% last month, which was up from 15.6% monthly price drop in September. Santa Barbara prices too fell again last month by 34.3%, after a 33% rise in October, and a 20.5% drop in September.

The Bay Area suffered huge drops in sales (-14.6%) and that was down 22.4% from 12 months ago. San Mateo home prices dropped .3% to $1,800,000, while in Monterey prices dropped fell 1.6% to $929,000. San Francisco home prices fell 5.5% whiles sales slumped 39%. Santa Clara too suffered a 17.3% drop.

San Bernardino bucked the trend with a 16.9% growth in sales.

In Southern California which has the biggest impact on the California average prices fell 4.2%. Orange County had sales drop 8.1% while prices jumped 14.9%. Los Angeles County saw prices drop 5% while sales declined 3%.

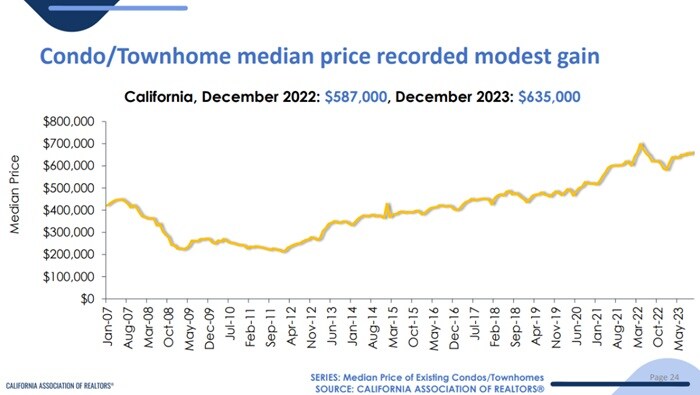

Condominium/Townhouse Market

As the stats reveal, condo prices fell $25,000 on average in December while sales slid 3.7%. Year over year, condo prices are still up 8.2%.

Condo Prices and Sales Year over Year. Screenshot courtesy of CAR.org.

Condo Price California. Screenshot courtesy of CAR.org.

2024 Market Forecast

CAR felt optimistic in its 2024 housing market forecast with falling mortgage rates, rising prices, economic expansion, and with demand for homes strong.

Home prices are predicted to rise 6.2% to a record median price of $680,300 next year. Housing affordability will remain flat. Out of all of it, and despite an outmigration of Californians to low-tax states, the state remains viable and people want to buy homes here.

RedFin Report California

Redfin’s house sales price numbers are just slightly below those of CAR.

Home price growth in California. Screenshot courtesy of Redfin.

Cities with Highest Rent Price Growth

California Metros with strongest Price growth in December. Screenshot courtesy of Redfin.com

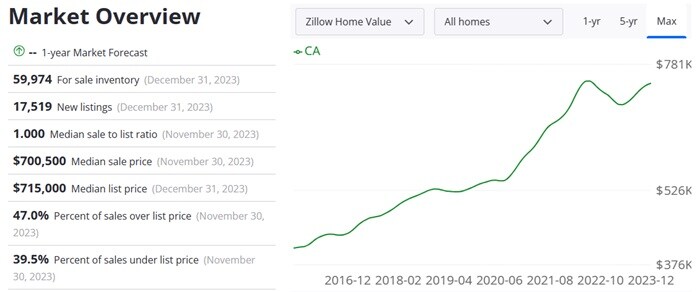

Zillow Report for California in December

Home Prices California, last 10 years. Screenshot courtesy of Zillow.com

* Many thanks to CAR, Redfin and Zillow for the market info and graphics.

Rental Property Management Excellence. Share on Your Website or Social Channels!

Will California Home Prices Fall in 2024?

Although the buyer market is deteriorating, there are plenty of buyers with funds who can jump into the market for homes or rentals when mortgage rates ease. Although rent prices are falling in California, and likely will further in 2024, there is always a possibility of higher California rent prices. as the economy rises from a short downturn. However, economists are divided on the economic outlook. With energy prices low and reshoring of manufacturing to the U.S, it’s hard to get gloomy about 2024 and beyond.

When mortgage rates fall further, it could set off a wave of homes on the market. This could present financial issues for landlords as renters leave rentals to occupy their own homes.

Rent prices are down $45 per month according to Zillow’s rental report for December 2023, and this down $230 from one year ago. There are 74,558 units for rent in its system.

The biggest factors for the housing market forecast:

- timing of FED drops in high-interest rates and mortgage rates

- inflation is easing, especially energy prices (for now)

- unemployment is expected to increase

- some return-to-head-office mandates are drawing Californians back to the big metros

- home prices strongly bolstered by economy

- supply is growing only slightly but not enough to fill buyer demand

- tech sector doing well yet looming rate driven recession will impact Silicon valleys fortunes

- repatriation of manufacturing will bolster US GDP and employment

- continued exodus of residents and businesses to lower tax states

Forecasted for This Year

Unexpectedly for most Realtors, homeowners and home sellers, the debt ceiling crisis may result in upward pressure on interest rates. If rates persist, it could deflate many of the optimistic projections for sales. And prices would likely still rise given the severe housing shortages.

C.A.R. Vice President and Chief Economist Jordan Levine predicted that “High inflationary pressures will keep mortgage rates elevated, which will reduce homebuyers’ purchasing power and depress housing affordability in the upcoming year. With borrowing costs remaining high in the next 12 months, a pull-back in sales and a downward adjustment in home prices are expected in 2023.”

Levine added, “Home prices will also moderate further over the next several months as interest rates remain elevated in the near term and seasonal factors come into play.”

The baseline scenario of C.A.R.’s “2024 California Housing Market Forecast” sees an increase in existing single-family home sales of 22.9 percent next year to reach 327,100 units, up from the projected 2023 sales figure of 266,200. The 2023 figure is 22.2 percent lower compared with the pace of 342,000 homes sold in 2022.”

The revised California median home price forecast is for a rise 0f 6.2% to $860,300 in 2024, a -1.5% drop this year to $810,000 from $822,300 in 2022. A persistent housing shortage and a competitive housing market will continue to put upward pressure on home prices next year.

California housing market forecast CAR Chart by Year. Screenshot courtesy of CAR.

The rental market however appears to be a different story from the home resales market. Rental property investors have a completely different opportunity to recover their costs (with well selected properties).

Californians Looking Elsewhere

California has the highest percentage of people looking to buy elsewhere. California, New York, District of Columbia, Massachusetts, and Illinois were the top 5 states homebuyers searched to move from. The top 5 states homebuyers searched to move to were Florida, Texas, Arizona, Maryland, and South Carolina.

The combination of housing market downturn risk, rising interest rates, and inflation may anke Californian homeowners consider selling their property this fall. Yet, letting go of low, locked in rates is perhaps the key reason why many will not sell. That selling intention is lessened by desires to get a comfortable price, having to make extreme relocation choices, and entering into a new, more expensive mortgage.

As layoffs in the corporate sector grow against fast-rising mortgage rates, August and September’s housing market decline may worsen the October and December outlook.

California Rent Prices

11 California cities ranked as most expensive for renters out of top 70 in the US according to a new report from Zumper. See recent California rent price stats provided by Zumper.com.

| 1 Bedroom | 2 Bedrooms | ||||||

| Rank | City | Price | M/M% | Y/Y% | Price | M/M% | Y/Y% |

| 2 | San Francisco, CA | $3,000 | 3.4% | 7.5% | $3,950 | -1.3% | 7.0% |

| 3 | San Jose, CA | $2,570 | 3.6% | 19.0% | $3,130 | 2.0% | 15.9% |

| 6 | Los Angeles, CA | $2,360 | 0.0% | 18.0% | $3,200 | 0.6% | 16.4% |

| 7 | San Diego, CA | $2,320 | -6.1% | 20.8% | $2,910 | -6.1% | 14.6% |

| 9 | Santa Ana, CA | $2,110 | 3.4% | 24.1% | $2,770 | -3.5% | 23.7% |

| 10 | Oakland, CA | $2,100 | 2.4% | 5.0% | $2,800 | 1.1% | 10.7% |

| 14 | Anaheim, CA | $1,860 | -2.6% | 12.0% | $2,470 | -6.1% | 22.3% |

| 18 | Long Beach, CA | $1,710 | -1.7% | 6.2% | $2,280 | -5.0% | 7.5% |

| 24 | Sacramento, CA | $1,600 | 0.0% | 8.8% | $1,980 | 1.0% | 7.6% |

| 31 | Fresno, CA | $1,520 | 6.3% | 25.6% | $1,680 | 5.0% | 15.1% |

| 69 | Bakersfield, CA | $1,060 | -1.9% | 9.3% | $1,380 | 0.7% | 15.0% |

Please note that CAR designates the Los Angeles Metropolitan Area as a 5- region that includes Los Angeles, Orange, Riverside , San Bernardino , and Ventura. The Bay Area includes: Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma. And the Inland Empire includes Riverside and San Bernardino counties.

Is it a Good Time to Buy a Home in California?

According to C.A.R.’s monthly Consumer Housing Sentiment Index, in April 2023, 59% of consumers said it was a good time to sell, up from 55% the previous. Only about 25% feel it is a good time to buy a home, unchanged from last year. With rent prices falling, is hanging on for a few more years wise? Will you be searching for a new rental home? See national rent prices city by city and cost of living city by city.

Will California’s Home Prices Continue to Rise in the next 12 months?

A lot of buyers are asking whether home prices will rise or fall? Renters are wondering if rent prices will fall? High demand, low mortgage rates, and low inventory will likely skew homes and condo prices higher. The trend is here and the return of buyers is here. A number of factors are contributing to California’s positive sales stats:

- desire to live away from the city in suburbs and rural regions and willingness top pay top dollar or homes

- record-low mortgage rates

- moving to regions (pandemic destination) that offer more room perhaps with an office or garden>

- wealthy buyers have the funds ready

“Low rates and tight housing inventory are contributing factors to the statewide median price setting a new record high three months in a row from June to August. A change in the mix of sales is another variable that keeps pushing median prices higher, as sales growth of higher-priced properties continued to outpace their more affordable counterparts,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young.

California Realtor’s Survey

The latest survey of Realtors shows fewer are withdrawing offer, more are listing new properties, and are not optimistic about sales or prices.

California Housing Market Forecast

C.A.R. Predicted More Home Sales and Higher Prices for 2021: Leslie Appleton-Young delivered her updated California housing market forecast for 2021. She expected sales to continue to improve through 2021.

The prediction is based on growing buyer demand that’s pushed California’s median price above $700,000 and low inventories that will cause price increases. As know now, sales have declined.

California’s weekly showings index rose to 182.3% higher than it was in September of 2019. Mortgage rates have dropped back down and purchase applications rose 24.2% on an annual basis last week.

Share the news and market insight on your blog!

This updated report covers important stats including home prices, sales, and recent home sales trends from CAR, NAR, DOT, St Louis Fed, NAHB, Statista, Zillow and more. For national home price trends see the US real estate housing market.

The key story with Los Angeles, San Francisco, San Jose, Santa Clara, San Diego, Orange County, Riverside, San Bernardino, etc. is the lack of listings.

Managing rental properties in California? See more on ManageCasa's platform for modern property managers.