HOA Budget Planning: 6 Essential Tips for 2025

Budget season is one of the most important times of the year for any Homeowners Association (HOA). A well-prepared budget keeps assessments fair, avoids surprise special assessments, and ensures long-term community stability. But in 2025, rising insurance premiums, utility costs, and vendor pricing make it more challenging than ever to strike the right balance.

The good news? Careful planning, consistent monitoring, and the right tools can transform the budget season from a stressful scramble into a strategic advantage. Whether you’re a small community or a large-scale association, the following six tips will help your board create a transparent, balanced, and future-ready budget, backed by insights on how ManageCasa simplifies the process.

As HOAs head into budget season, careful planning is crucial to avoid special assessments, maintain fair assessments, and preserve property values. With inflation, rising insurance premiums, and vendor costs increasing, this year’s budgets demand extra attention.

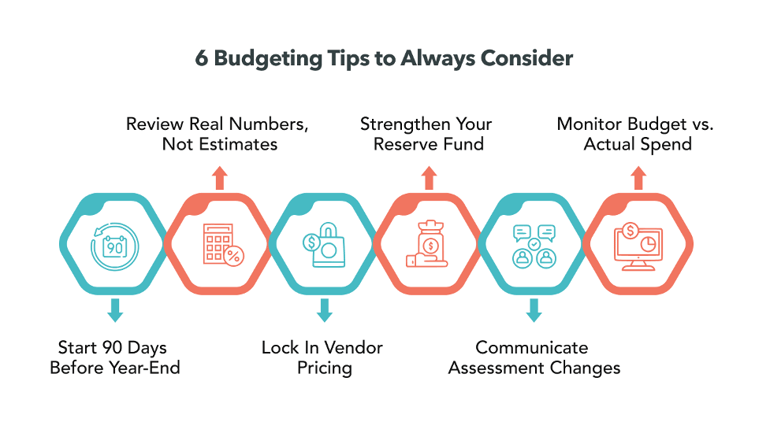

6 Budgeting Tips to Always Consider

1. Start 90 Days Before Year-End

Most successful associations begin budget planning at least three months prior to the end of the fiscal year. This gives enough time to collect vendor bids, review contracts, and prepare accurate drafts. Form a budget committee with the treasurer, one or two homeowners with financial experience, and your community manager.

2. Review Real Numbers, Not Estimates

Outdated numbers are the fastest way to blow a budget. Go line by line through last year’s operating statements. Compare actual spending to the budget and flag categories that exceeded their allocation. For example, insurance premiums have increased by an average of 71.5% per unit between 2022 and 2024, now consuming over a third of many HOA budgets. Utilities rose 8–10% annually in many regions. Build these increases into your draft rather than assuming last year’s numbers will hold.

3. Lock In Vendor Pricing

Request updated bids from landscapers, pool contractors, security providers, and waste management companies before finalizing the budget. Associations that solicit multiple bids and renegotiate contracts report saving 15–20% annually.

4. Strengthen Your Reserve Fund

Experts recommend contributing 10–40% of your annual budget to reserves, depending on the age of your community and upcoming projects. Update your reserve study annually to reflect the true replacement costs of roofs, paving, elevators, and other capital items. HOAs that keep reserves at or above 70% funded rarely face special assessments (fsresidential.com).

5. Communicate Assessment Changes

Transparency makes dues increases easier to accept. If dues need to rise, explain why clearly. Show side-by-side comparisons of last year’s vs. this year’s numbers, and highlight major drivers such as insurance or utilities. Surveys show 73% of HOAs address rising costs by raising assessments, while only 15% cut reserves (doorloop.com). Transparency reduces resistance and builds trust.

6. Monitor Budget vs. Actual Spend

The best budgets are living documents. The budget shouldn’t be filed away after approval. Add a standing agenda item at each board meeting to review budget vs. actuals. If water bills spike or repair costs exceed expectations, the board can make mid-year adjustments before problems escalate.

Example: Insurance Impact on a 100-Unit HOA

Suppose your HOA budgeted $83,700 for insurance in 2022, or $837 per unit. With a 71.5% increase:

- 2024 rate: $1,436 per unit

- New total: $143,600

That’s a $60,000 increase that must be absorbed through higher assessments, reduced spending elsewhere, or larger reserve allocations.

Quick Reference Table

|

Step |

Action |

Why It Matters |

|

Start 90 Days Early |

Form committee, gather bids, review contracts |

Avoids rushed budgets and missed costs |

|

Use Real Data |

Factor in insurance + utility increases |

Prevents underfunding |

|

Lock in Vendor Rates |

Solicit multiple bids |

Saves 15–20% annually |

|

Strengthen Reserves |

Contribute 10–40% annually |

Avoids special assessments |

|

Communicate Assessments |

Share side-by-side budget data |

Builds trust with owners |

|

Monitor Monthly |

Compare budget vs. actuals |

Allows mid-year corrections |

Future-Proof Your HOA Finances with ManageCasa

At the end of the day, budget planning isn’t just about crunching numbers; it’s about protecting property values, building trust with homeowners, and keeping your community financially healthy. By starting early, using real data, strengthening reserves, and monitoring progress throughout the year, your HOA can navigate rising costs with confidence.

With ManageCasa, boards gain the automation, transparency, and real-time financial insights needed to plan smarter and execute better.

Key ways ManageCasa simplifies budget planning:

- Automated reporting: Instantly generate P&L, cash flow, and reserve contribution summaries.

- Assessment tools: Adjust dues and see real-time cash flow impacts.

- Reserve planning dashboards: Visualize reserve funding, health, and future needs.

- Owner transparency: Share draft budgets and financial updates directly through portals.

With ManageCasa, you can:

- Automate repetitive tasks and streamline requests.

- Keep residents, managers, and boards connected on web and mobile.

- Maintain transparency with real-time reporting and clear records.

- Scale from a single HOA to thousands of units without hidden costs.

Budget season is the best time to strengthen your HOA’s financial health. With ManageCasa, boards can plan early, use accurate data, and keep residents informed, turning a stressful process into a strategic advantage. Try our blog: Budgeting for HOA: A Complete Guide to Financial Planning for Your Community for more insights!

Book a free demo and see why ManageCasa is the HOA-first alternative to enterprise software like Yardi, AppFolio, or PayHOA.